This year, GRESB participation reached a new milestone, with 2,223 real estate participants – including 132 from Australia – representing over $10 trillion in global real estate assets. Every November when the results are released to the wider public, we gain valuable insights into the performance of these funds.

Now that the 2024 GRESB results are here, there’s a lot to unpack. Below are my top takeaways from this year’s results, along with the key areas to watch as we move forward into the next 12 months.

Oceania regains global number one spot

Asia’s dominance in global real estate rankings was short-lived. After a brief setback in 2023, when Asia surpassed Oceania in the Real Estate Benchmark for the first time in over a decade, Oceania has reclaimed its top position in the 2024 GRESB results. Once again, Australian and New Zealand property companies are leading the way in sustainability, topping both the Standing Investments and Development benchmarks.

At the 2023 results event in Sydney, where Oceania’s decade-long streak was overtaken by Asia, it was clear that industry leaders were determined to regain the top spot. In the months that followed, property companies ramped up their investments to reclaim their leadership position, showcasing how a unique blend of competition and collaboration within the sector can drive both innovation and progress.

It must be noted that there was a 15% growth in the Asian market – more than other regions. Typically first year participants score lower than second, third year. The gains in score from Year 2 become significant, so we could see a much stronger showing from Asia in 2025 given the new participants would be gaining points significantly.

Building certifications remain an opportunity

The Building Certifications aspect, featured in both the Performance and Development components, continues to be an area with significant room for improvement. In other words, it presents a major opportunity for participants to score and outperform peers. Interestingly, in the Performance component, the adoption of Building Certifications dropped from 60.9% in 2023 to 59.3% in 2024. This decrease is likely due to the influx of new participants who have yet to prioritise certifications across their portfolios. In contrast, the Development component saw an increase in Building Certifications, rising from 85.9% in 2024 to 88.3% in 2025.

GRESB places considerable emphasis on Building Certifications, likely due to their comprehensive nature and the rigorous verification process involved, particulate those labelled Tier 1 Certifications. These certifications offer the assurance GRESB seeks, making them a critical factor in the Benchmark and contributing significantly to an organisation’s overall score. Given the competitive nature of GRESB, an organisation aiming for a 4 or 5 Star rating will struggle to achieve this without widespread adoption of Building Certifications across its funds.

It’s important to note that while GRESB directly rewards Building Certifications with points, they also provide additional benefits within the GRESB framework. Achieving specific outcomes through rating tools (e.g., earning certain credits) can serve as validation or evidence for other GRESB indicators beyond just the Building Certification aspect. Therefore, while using rating tools is essential, crafting a strategy that maximises their impact is equally important for achieving a strong GRESB performance.

Brown-to-Green investing

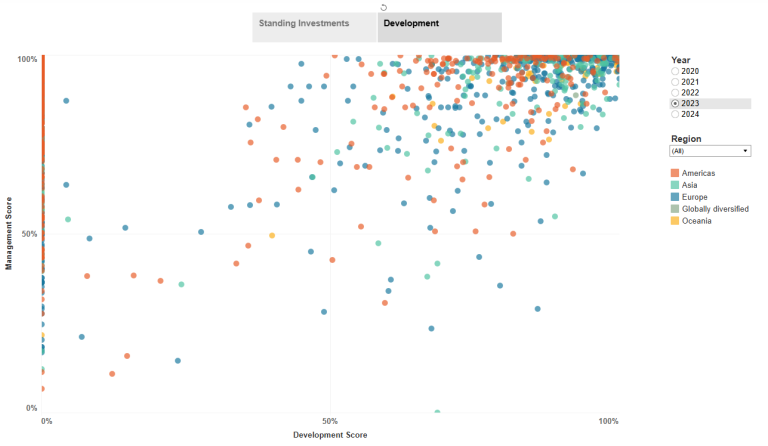

A comparison of the 2023 and 2024 results in the Development component clearly shows that GRESB is being effectively used as a tool for improvement. Notably, the lower-left quadrant (or, just the left side of the graph), which show a significantly higher number of participants in 2023 compared to 2024, highlights a shift toward brown-to-green investment strategies – an approach that is increasingly gaining traction among investors.

Brown-to-green investing refers to the process of sending capital towards “brown” assets – those associated with high carbon emissions, environmental degradation, or unsustainable practices – toward “green” investments, which focus on sustainability and low-carbon in an attempt to improve the ESG performance of the asset.

In the context of GRESB, this shift means that funds are actively reinvesting in their assets by implementing interventions such as renewable energy projects, energy efficiency upgrades, clean technologies, and other sustainability initiatives. These actions help improve overall ESG (Environmental, Social, and Governance) performance while mitigating environmental risks. The ultimate goal of brown-to-green investing is to align investment portfolios with sustainable principles, reduce exposure to high-carbon sectors, and capitalise on the rapidly expanding green economy.

A focus at the asset-level

Remarkably, 80% of participants in the Standing Investments Benchmark scored an average of at least 27.5 out of 30 points in the Management component. In the Development Benchmark, 80% of participants achieved an average score of 27 out of 30 points. These results highlight the maturity of ESG management at the organisational level, indicating that tangible gains can now only be made by focusing on improvements at the individual asset level. Organisations that continue to concentrate solely on broad, organisation-wide initiatives risk falling behind – if they haven’t already – while those that prioritise enhancing the sustainability performance of individual assets will continue to see rewards and gains.

Furthermore, the changes to the 2025 GRESB Assessment (see some notable ones below) again signal a greater focus at the asset level. While more can – and should – always be done at the organisation level, the time has passed to gain a notable competitive advantage in the benchmark.

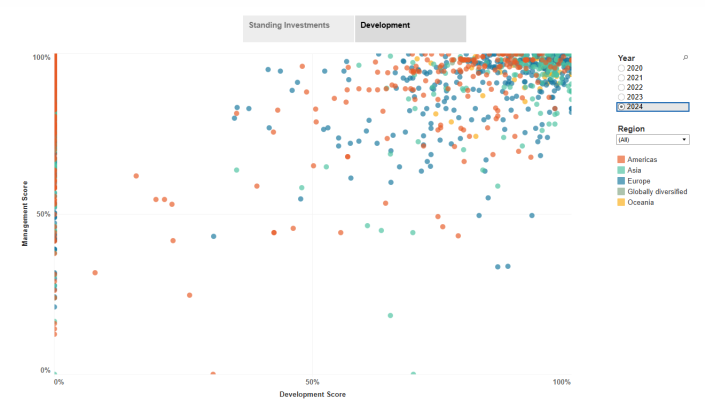

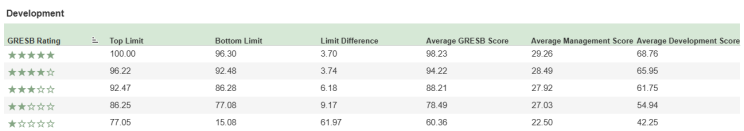

The margins remain incredibly tight

Maintaining a 5 Star GRESB Rating is extremely challenging due to the highly competitive nature of the GRESB assessment. Just take a look at the table below in the Development benchmark:

Notice that there is less than 10-point that differentiate between achieving a 3 Star and a 5 Star rating, and just a 3.74-point gap between the bottom of a 4 Star and bottom of a 5 Star Rating. These figures highlight the intense competition within GRESB, where every single point counts and is crucial for staying in the top tier. This becomes even more significant when considering the rise of sustainability-linked loans, which are frequently tied to key performance indicators (KPIs) such as GRESB Star ratings (typically 4 or 5 Stars). In GRESB, the pursuit of every individual point, year after year, is very much a worthwhile endeavour.

To stay ahead of the curve, participants must continually anticipate upcoming changes and prepare accordingly. By staying informed about future updates – available on the GRESB website – organisations can proactively implement necessary interventions, positioning themselves to earn higher scores in future assessments and maintain a slight edge over their competitors, and continue to benefit from their sustainability-linked loans.

The GRESB Foundation makes changes to the assessment each year, gaining insights from the both participants and investors and aligning it with their their longer-term priorities and strategies. There are both tactical and strategic changes made to the assessment each year, both of which have an impact on the results of participants. Below are some notable ones to watch for the next 12-months.

Impact of 2024 Building Certifications

Given the emphasis on building certifications in both the Development and Performance components, it’s no surprise that one of the most significant changes in recent years was the introduction of a “time factor” for building certifications (in 2024). This new factor takes into account the age of a certification when calculating scores for indicators BC1.1 and B1.2. For Design and Construction Certifications, only buildings certified within the past 3 years receive a full 100% weighting, while those older than 5 years carry a reduced weighting of 80%. For Operational Certifications, the time factor has a more severe impact on performance – certifications older than 5 years no longer contribute to the score, as they carry a weighting of 0%.

Typically, operational certifications (such as Green Star – Performance in Australia) are renewed annually, so the time factor is less likely to impact funds in the Standing Investments Benchmark. However, funds participating in the Development Benchmark will be more affected over time unless upgrades are made to their assets or designs. By 2025, we will start to see a clearer distinction between those who have invested in upgrading their assets during the 2024 calendar year. The time factor will likely play a significant role in 2025, given its impact on the total points available in the Building Certification category.

In addition to the time factor, GRESB has repeatedly indicated plans to revise the criteria for certification schemes recognised under the GRESB Standard, aiming to improve the quality of certification schemes. The increasing number of recognised certifications has created confusion for investors and complexity for benchmark participants. While the revised criteria have been approved, they have not yet been published. Participants who have relied on “less rigorous” certification schemes and benefitted from GRESB’s recognition of those certifications may find themselves scrambling to achieve more robust certifications once the changes take effect. GRESB has stated that the list of schemes will be introduced in 2026, with the impacts on reporting and scoring expected to be felt in 2027. This has been a great move from the GRESB team.

Resurgence from Asia?

As mentioned earlier, Asia saw the most significant growth among all GRESB markets, with an impressive 15% year-on-year increase in participants. It’s well known that first-year participants tend to score lower (in 2024, the average score for new participants was 62%), which is expected given their limited experience with the assessment process. However, it’s also true that the second year often sees the most significant score improvements, as participants become more familiar with the process, the GRESB Standard, and begin to see the benefits of the interventions they implemented in Year 1. For example, the average score improvement for a second-year participant is around 10%, while a fifth-year participant typically sees only a 1% – 2% improvement, on average.

Given these insights – namely, that Asia has the highest number of new participants and the greatest potential for score gains in Year 2 – other markets should take notice. Asia could very well challenge for the top spot once again. Despite the influx of new participants, Asia was only marginally behind Oceania in both benchmarks in 2024.

It’s also worth noting that Oceania, which regained its top position over Asia in the 2024 results, actually saw a slight decrease in the number of participants, dropping from 143 in 2023 to 141 in 2024. With a global race for capital, a resurgence in Asia could pose significant challenges for other markets moving forward. India grew the most within the Asian market, signaling property company’s desire to continue to attract foreign capital and using ESG as a key lever to do so.

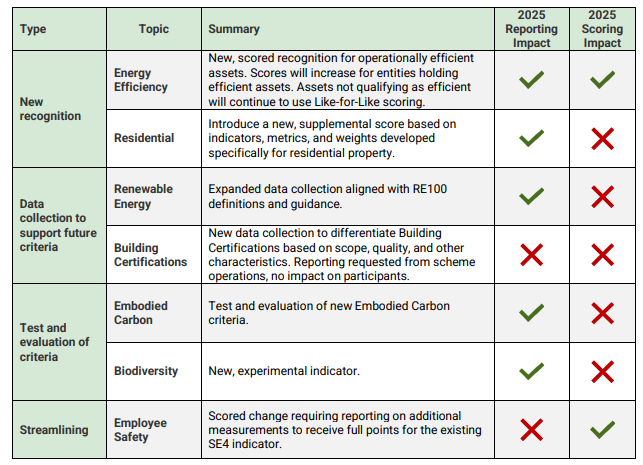

2025 Reporting vs Scoring Impacts

GRESB takes both a strategic and tactical approach when updating the assessment or introducing new topics. Typically, a new addition to the GRESB Standard will first affect reporting but not impact the score. After one or two years, and based on feedback from participants and investors about its application and value, the topic is then integrated into the scoring system. We’ve seen this in action with the introduction of the Health and Wellbeing module. Initially voluntary, it received positive feedback and was later incorporated into the assessment, with associated indicators now being scored across multiple aspects.

Organisations that go beyond the 2025 expectations for the topics listed in the table below will have a head start when these topics are eventually included in the scoring, whether in 2026 or 2027. To stay ahead, participants should focus on these key areas in 2025, exceeding GRESB’s requirements and making significant investments in interventions to address these emerging issues.

Biodiversity takes the spotlight

GRESB has responded swiftly to the release of the Taskforce for Nature-related Financial Disclosure (TNFD) recommendations in September 2023 by introducing updates related to biodiversity and nature. Over recent years, biodiversity and nature have become increasingly important in the real estate sector.

The scope of biodiversity and nature reporting has been expanded to include a new, unscored indicator focused on Biodiversity and Nature-related strategies. This update aligns with the TNFD recommendations, ensuring a more comprehensive and market-aligned approach to managing nature-related risks and opportunities. Participants are now required to provide details on their Biodiversity and Nature strategy, including an overview of dependencies, risks, and opportunities.

Looking ahead, the Foundation plans to use participants’ results from the 2025 assessment to inform future updates to the GRESB Standard, gradually incorporating biodiversity and nature-related reporting into the broader performance assessment framework. If the advice hasn’t come through already, participants shout take these GRESB signals seriously and focus on the topic over the coming 12-months.

Country and Sector Level Benchmarks

In 2024, the GRESB Real Estate Standard underwent significant updates that are reshaping how participants and investors interpret the assessment results. A key change was the increased emphasis on data quality and granularity. In response to investor feedback, the assessment now allows for more detailed benchmarking at the country level rather than the previous regional approach. This shift enables a more precise comparison of sustainability performance within specific markets. Given capital flows freely across regions, this shift will be welcomed by many.

With investors now having access to more granular data – an especially valuable asset given the growing flow of capital into real estate – we can expect this focus on data to continue in the years ahead. GRESB is likely to refine its benchmarking even further, adjusting the requirements and expectations for documentation and data from participants. Some organisations may have relied on relatively basic or rudimentary data collection systems, but those with more advanced or mature data processes will be better positioned to meet these evolving expectations. These organisations will continue to benefit from the increased focus on granularity, ensuring they align more closely with investor demands.

The dynamic nature of GRESB fuels both competition and progress. The steady increase in participants since 2013 is directly linked to the growing value that investors place on data that enhances investment decisions – specifically, the need for normalised, comparable, and standardised performance metrics across funds and assets. No participant can afford to become complacent, as the benchmark continues to evolve, and to improve, a company must consistently outperform its peers each year.

Looking ahead to 2025, one key takeaway from the 2024 results is the continued focus on Building Certifications, which are undergoing significant changes and will have an even greater impact on scoring in the years to come. Evaluating which certification frameworks are adopted, the age of those certifications, and the overall certification strategy will become increasingly critical. As noted by the GRESB Real Estate Standard Committee (RESC):

“The RESC has repeatedly acted to recognise the value of green building certifications as useful proxies for the sustainable design and operational performance of real estate assets. This rests on a large body of scientific literature showing strong correlations between building certifications and social, environmental, and economic performance.”

At AESG, we understand and appreciate the value of achieving a strong GRESB score. With many years of expertise in sustainability consulting and advisory, AESG is uniquely positioned to guide clients through the GRESB assessment process, helping them to achieve desired results. Our GRESB advisors are able to help participants:

With AESG’s comprehensive support, you can approach your GRESB submission with confidence, knowing you have a team of experts helping you navigate the complexities of the process and achieving satisfying results year-on-year.

Director of Sustainability, AESG Australia

Devan joins AESG as Director of Sustainability for Australia. With over a decade of dedicated experience in the realm of sustainability across three continents, Devan Valenti holds a deep understanding of Environmental, Social, and Governance (ESG) practices within the property sector.

He previously served the Asia Pacific market as Senior Manager and ESG Lead for the International WELL Building Institute (IWBI) where he provided strategic ESG guidance to both institutional investors and property developers. With a keen understanding of the evolving landscape of sustainability, Devan has leveraged his expertise to guide clients through the intricacies of ESG integration, helping them identify and capitalise on opportunities for long-term value creation.

Throughout Devan’s career, he has spearheaded numerous initiatives aimed at promoting sustainability across various sectors, the most notable being his involvement in the development of Green Star Buildings, the largest overhaul in the rating tool’s 20-year history. Leading the transformative three-year endeavour, which involved input from over 2,000 influential stakeholders, Green Star Buildings now stands as a cornerstone embraced by most Australian property developers. Noteworthy contributions under Devan’s leadership include the successful introduction of Net Zero requirements and a heightened focus on embodied carbon in building materials within the Green Star framework.

Devan holds a Master’s degree from Stellenbosch University, South Africa, where his thesis delved into the complexities of clean energy policy. Committed to driving tangible impact through ESG integration, he aspires to equip clients with the tools necessary to leverage ESG performance as a catalyst for both business success and positive societal change.

For further information relating to specialist consultancy engineering services, feel free to contact us directly via info@aesg.com

ISO 27001:2022

ISO 9001:2015

ISO 14001:2015

ISO 45001:2018

601-608

The offices at Ibn Battuta Gate,

Jebel Ali 1-Village

PO Box 2556

Dubai, United Arab Emirates

305 Mermaid House

2 Puddle Dock

London, EC4V 3DS

United Kingdom

T / +44 (0) 208 037 8762

Haibu Space, Abu Dhabi Mall

1st floor, Office 37

Tourist Club Area

Abu Dhabi, United Arab Emirates

T / +971 (0) 2 201 2527

9391 Wadi Al Thummamah

2444 Al Olaya District

PO Box 12214

Riyadh, Kingdom of Saudi Arabia

T / +966 (0) 112 278 288

111 Somerset Road

#08-10A, 111 Somerset

Singapore 238164

11th Floor, Office 1101

2 Long Street

Cape Town 8000

Western Cape, South Africa

T / +27 (0) 21 137 6444

8 Parramatta Square

49th Floor, Office 117

Parramatta, Sydney

New South Wales 2150

Australia

T / +61 (0) 2 8042 6817

Regus Rialto, West Podium

Level Mezzanine 2 (M2)

525 Collins Street

Melbourne, Victoria 3000

Australia

Regus Egypt, East Lane

1st Floor, Office 130

Plot number B-340

New Cairo 1

Cairo Governorate 4740003

Egypt

Office 37, Haibu Space

1st floor, Abu Dhabi Mall

Tourist Club Area

Abu Dhabi, United Arab Emirates

T / +971 (0) 2 201 2500

9391 Wadi Al Thummamah

2444 Al Olaya District

PO Box 12214

Riyadh, Kingdom of Saudi Arabia

T / +966 (0) 112 278 288

111 Somerset Road

#08-10A, 111 Somerset

Singapore 238164

WeWork, 80 Strand St

Cape Town City Centre

Cape Town, 8001

South Africa

T / +27 21 137 6444

49th Floor, Office No.117

8 Parramatta Square

Parramatta, Sydney

New South Wales 2150

Australia

T / +61 (0) 2 8042 6817

Regus Rialto, West Podium

Level Mezzanine 2 (M2)

525 Collins Street

Melbourne, Victoria 3000

Australia

Enawalks, 4th Floor, Office 417

Leaders International College Road

2F97+6VJ New Cairo 1

Cairo Governorate 4724242

Egypt

T / +20 15 01692187